VANCOUVER, British Columbia, Nov. 06, 2024 (GLOBE NEWSWIRE) -- Latin Metals Inc.(“Latin Metals” or the “Company”) - (TSXV: LMS) (OTCQB: LMSQF), is pleased to announce it has successfully completed payment obligations to the underlying owner (the “Vendor”) to vest a 71% ownership interest in the Cerro Bayo and La Flora properties (collectively “Cerro Bayo” or the “Properties”) in Santa Cruz Province, Argentina, strengthening the Company’s precious metals portfolio. Latin Metals has an option for 100% ownership, subject to a 0.75% NSR royalty (of which 0.5% can be purchased for US$1 million).

Exploration Potential at Cerro Bayo

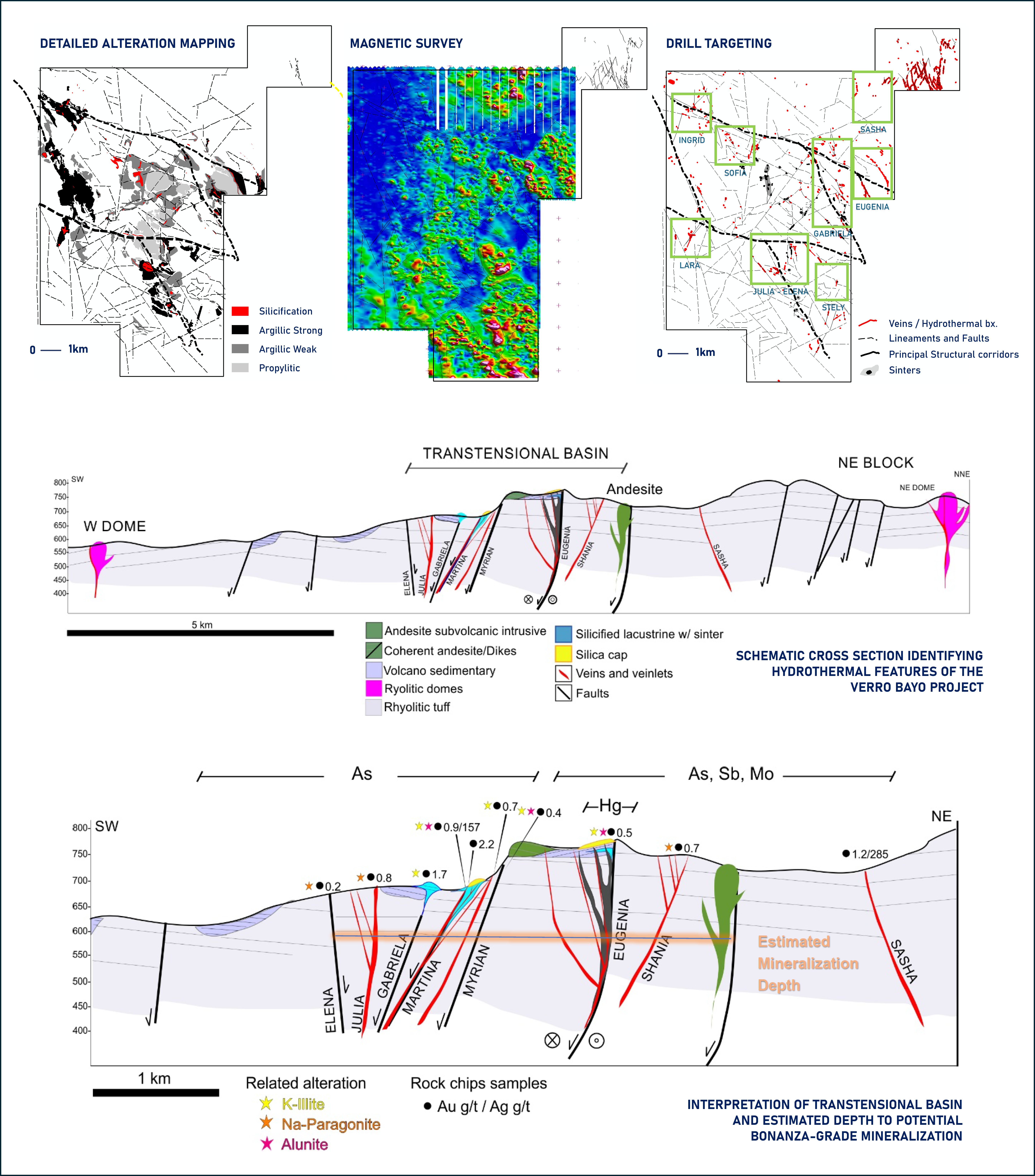

The Cerro Bayo and La Flora properties, previously optioned out to Barrick Gold Corporation (NYSE: GOLD) (“Barrick”), have undergone extensive surface exploration and drill targeting (Figure 1). Located within the prolific Deseado Massif, a region known for high-grade gold-silver deposits, the properties exhibit evidence for the existence of low-sulfidation epithermal systems. The geological model indicates potential for gold-silver bonanza vein mineralization at accessible depths of 150 to 200 meters.

The district’s closest high-grade analog is Newmont’s Cerro Negro mine, located 70 kilometers north, where similar ore shoots are found below the palaeosurface, suggesting substantial potential for high-grade discoveries at Cerro Bayo.

A major west-northwest trending dextral structure is interpreted as a transtensional fault defining a favourable structural zone 6km wide, traversing the entire Cerro Bayo property.

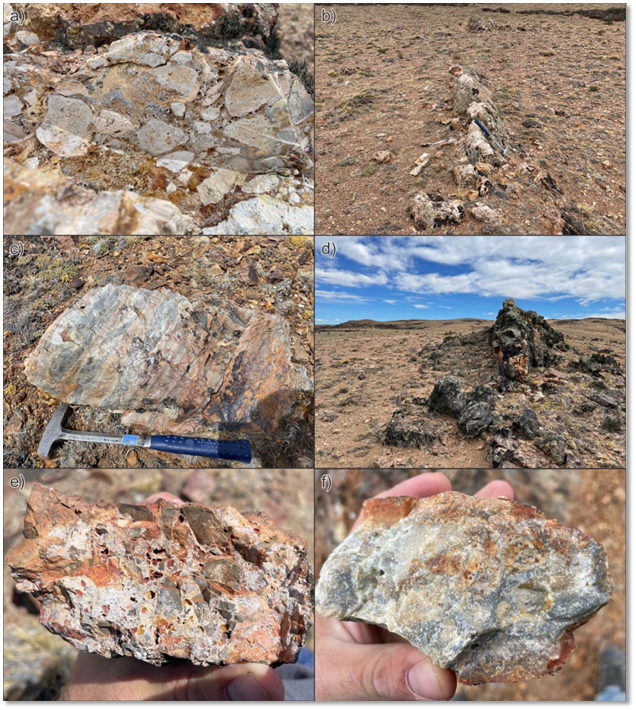

Gold and silver grades are related to As, Sb, Hg, and Mo pathfinder elements (Figure 1), indicating a shallow epithermal system. Silver-gold ratios vary from 10:1 to 200:1. Higher grade gold concentrates about 100m to 150m below palaeosurface. Although outcrop is sparse, various veins have been mapped and samples (Figure 2).

Drill Permit and Partnership Strategy

Latin Metals has been working towards a drill permit at Cerro Bayo and expects to conclude that process in Q4 2024. The Company is actively seeking an option partner to complete comprehensive exploration activities, including trenching, gradient array induced polarization (IP), CSAMT, and initial drill testing in 2025.

Cautionary Statement Regarding Adjacent Property

Readers are cautioned that the Cerro Negro mine discussed above is adjacent properties and that the Company has no interest in or right to acquire any interest in the deposit, and that mineral deposits on adjacent or similar properties, and any production therefore or economics with respect thereto, are not in any way indicative of mineral deposits on Latin Metals’ properties or the potential production from, or cost or economics of, any future mining of any of Latin Metals’ mineral properties.

Figure 1: Summary of key exploration completed by Barrick showing detailed alteration mapping, magnetic data, drill taregt areas, scematic cross sections and interpretation of transtensional basin and estimated depth to target mineralization.

Figure 2: a) channel sample of hydrothermal breccia on Sasha vein where rock ship samples return 1.2 g/t gold and 285 g/t silver. b) Ingrid northwest striking quart vein outcrop grading 2.1 g/t gold and 460 g/t silver. c) Euginia opaline silica replacement. d) northwest trending quartz vein. e) Gabriela crystalline quartz breccia with silicifies volcanosedimentary clasts grading 1.68 g/t gold and 27.4 g/t silver. f) Julia quartz vein with fine saccharoidal texture grading 0.7 g/t gold.

Value Proposition in Santa Cruz Province

Santa Cruz Province, known as Argentina’s premier mining region, represents a key area for gold and silver production, contributing approximately 42% of the country's total mineral exports. Supported by robust infrastructure and a skilled workforce, the province boasts six operating mines, including AngloGold Ashanti’s (NYSE: AU) Cerro Vanguardia, which has been in operation for over 25 years. This proven mining district offers both stability and significant potential for resource growth, making it an attractive destination for exploration and investment.

The province’s precious metals production in 2023 reached notable levels, with over 680,000 ounces of gold and 15.2 million ounces of silver extracted, emphasizing its geological wealth. Since 1990, nearly 600 million ounces of silver and 20 million ounces of gold have been discovered within the region, reflecting a rich exploration history with demonstrable discovery record.

Santa Cruz’s mining sector supports approximately 9,000 jobs, accounting for 22.5% of Argentina’s national mining workforce, with one in four of the country’s miners employed within the Province. This workforce is bolstered by a mining-friendly regulatory environment and established infrastructure that includes well-developed transportation and energy resources. Such factors reinforce the investment value of Santa Cruz, where Latin Metals’ Cerro Bayo project is strategically positioned to benefit from this well-supported mining ecosystem and proven discovery potential.

About Latin Metals

Latin Metals is a mineral exploration company acquiring a diversified portfolio of assets in South America. The Company operates with a Prospect Generator model focusing on the acquisition of prospective exploration properties at minimum cost, completing initial evaluation through cost-effective exploration to establish drill targets, and ultimately securing joint venture partners to fund drilling and advanced exploration. Shareholders gain exposure to the upside of a significant discovery without the dilution associated with funding the highest-risk drill-based exploration.

Stay up-to-date on Latin Metals developments by joining our online communities on X, Facebook, LinkedIn and Instagram.

Qualified Person

Keith J. Henderson, P.Geo., is the Company's qualified person as defined by NI 43-101 and has reviewed the scientific and technical information that forms the basis for portions of this news release. He has approved the disclosure herein. Mr. Henderson is not independent of the Company, as he is an employee of the Company and holds securities of the Company.

On Behalf of the Board of Directors of

LATIN METALS INC.

“Keith Henderson”

President & CEO

For further details on the Company readers are referred to the Company's web site (www.latin-metals.com) and its Canadian regulatory filings on SEDAR at www.sedar.com.

For further information, please contact:

Keith Henderson

Suite 890 - 999 West Hastings Street,

Vancouver, BC, V6C 2W2

Phone: 604-638-3456

E-mail: info@latin-metals.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, the anticipated content, commencement, timing and cost of exploration programs in respect of the Property and otherwise, anticipated exploration program results from exploration activities, and the Company's expectation that it will be able to enter into agreements to acquire interests in additional mineral properties, the discovery and delineation of mineral deposits/resources/reserves on the Properties, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, market fundamentals will result in sustained precious and base metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future development of the Company’s Argentine projects in a timely manner, the availability of financing on suitable terms for the development, construction and continued operation of the Company projects, and the Company’s ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development and mine development activities at the Properties, including the geological mapping, prospecting and sampling programs being proposed for the Properties (the "Programs"), actual results of exploration activities, including the Programs, estimation or realization of mineral reserves and mineral resources, the timing and amount of estimated future production, costs of production, capital expenditures, the costs and timing of the development of new deposits, the availability of a sufficient supply of water and other materials, requirements for additional capital, future prices of precious metals and copper, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, possible variations in ore grade or recovery rates, possible failures of plants, equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, delays or the inability of the Company to obtain any necessary permits, consents or authorizations required, any current or future property acquisitions, financing or other planned activities, changes in laws, regulations and policies affecting mining operations, hedging practices, currency fluctuations, title disputes or claims limitations on insurance coverage and the timing and possible outcome of pending litigation, environmental issues and liabilities, risks related to joint venture operations, and risks related to the integration of acquisitions, as well as those factors discussed under the heading as well as those factors discussed under the heading “Risk Factors” in the Company’s annual management’s discussion and analysis and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company’s profile on the SEDAR+ website at www.sedarplus.ca.

Readers are cautioned not to place undue reliance on forward looking statements. Except as otherwise required by law, the Company undertakes no obligation to update any of the forward-looking information in this news release or incorporated by reference herein.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/f56a3f78-687b-48aa-b61f-e799da0815ff

https://www.globenewswire.com/NewsRoom/AttachmentNg/ce7af91a-53d3-4937-ac63-78750c059f27

Figure 1:

Summary of key exploration completed by Barrick showing detailed alteration mapping, magnetic data, drill taregt areas, scematic cross sections and interpretation of transtensional basin and estimated depth to target mineralization.

Figure 2:

a) channel sample of hydrothermal breccia on Sasha vein where rock ship samples return 1.2 g/t gold and 285 g/t silver. b) Ingrid northwest striking quart vein outcrop grading 2.1 g/t gold and 460 g/t silver. c) Euginia opaline silica replacement. d) northwest trending quartz vein. e) Gabriela crystalline quartz breccia with silicifies volcanosedimentary clasts grading 1.68 g/t gold and 27.4 g/t silver. f) Julia quartz vein with fine saccharoidal texture grading 0.7 g/t gold.

© 2026 Canjex Publishing Ltd. All rights reserved.