(via TheNewswire)

Toronto, November 7, 2025 – TheNewswire - Nuinsco Resources Limited (“ Nuinsco ” or the “ Company ”) (CSE: NWI) today announced a non-brokered private placement of flow-through common shares (“ Flow-Through Shares ”) and common shares (“ Common Shares ,” collectively the “ Private Placement ”). Under the Private Placement, the Company could issue up to 100,000,000 Flow-Through Shares and/or Common Shares, dependent on investor demand, priced at $0.005. The Private Placement is expected to close on or about December 4, 2025.

Proceeds from the sale of Flow-Through Shares will be used to fund work to advance the Company’s Prairie Lake critical minerals project located near Terrace Bay, Ont.; proceeds from the sale of Common Shares will be used for future general corporate purposes.

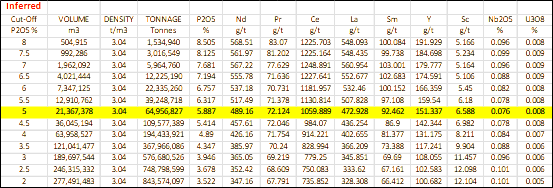

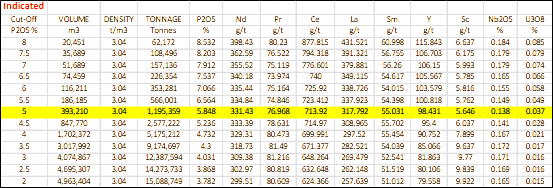

Nuinsco’s focus project, Prairie Lake, is a critical minerals asset with a phosphate – rare earth element ( “REE” ) mineral resource estimate ( “MRE” ) of close to 900 million tonnes (15.6 million tonne indicated and 871.8 million tonne inferred, using a 2% P 2 O 5 cut-off grade) - see MRE table below. Crucially, using an increased 5% P 2 O 5 cut-off grade , as reported August 13, 2024, has led to the identification of a domain that comprises a 65 million tonne Inferred MRE sensitivity grading 5.9% P 2 O 5 and a 1.2 million tonne Indicated MRE sensitivity grading 5.8% P 2 O 5, within the existing MRE, and with coincident increase in REE co-concentrate grade. The presence of such a domain of higher-grade critical mineral endowment combined with a multitude of favourable characteristics – technical, logistical, geographic, and strategic necessity – may have great significance to the development of Prairie Lake.

Metallurgical studies to date demonstrate that a clean phosphate concentrate, containing valuable REE co-concentrate, can be reliably produced from Prairie Lake rock. The Potential for niobium co-product is also apparent and is being investigated.

The elements found at Prairie Lake are essential for applications in transportation, power distribution and storage, steel fabrication, green technologies and agriculture, to name a few. The project boasts substantial, already established, logistical advantages, including easy access to:

Nearby communities - all able to supply a local, skilled workforce.

An all-weather forest access road crossing the project and deposit.

Paved Highways 17 and 11 to the south and north respectively.

Canadian Pacific Railway and Canadian National Railway networks.

A high capacity (230kV) electrical power transmission line.

The Marathon deep water port project (50 km away), able to accommodate ocean-going ships. Deep-water ports are also located at Thunder Bay and Sault Ste. Marie, Ontario.

The Marathon airport.

Prairie Lake Project 2022 Pit-Constrained Mineral Resource E stimate (1-6)

| | | | Rare Earth Oxides | Niobium | Phosphate |

Class | Cut-Off | Tonnes | Nd2O3 | Pr6O11 | Sc2O3 | CeO2 | La2O3 | Sm2O3 | Ta2O5 | Y2O3 | TREO | Nb2O5 | P2O5 |

| | NSR C$/t | M | g/t | g/t | g/t | g/t | g/t | g/t | g/t | g/t | kg/t | % | % |

Indicated | 30 | 15.6 | 344 | 96 | 15 | 754 | 300 | 58 | 28 | 100 | 1.67 | 0.16 | 3.71 |

Inferred | 30 | 871.8 | 409 | 82 | 18 | 905 | 388 | 79 | 17 | 127 | 2.01 | 0.10 | 3.39 |

MRE Sensitivity Analysis

*TREO = Total Rare Earth Oxides: neodymium, Nd 2 O 3 ; praseodymium, Pr 6 O 11 ; scandium, Sc 2 O 3 ; Cerium, CeO 2 ; lanthanum, La 2 O 3 ; samarium, Sm 2 O 3 ; yttrium, Y 2 O 3.

A full description of methodology used to estimate the Prairie Lake project Mineral Resource Estimate is contained in the NI 43-101 compliant Technical Report, effective date 31 May 2022 prepared by P&E Mining Consultants Inc. that is filed on SEDAR.

1. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

3. The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could potentially be upgraded to an Indicated Mineral Resource with continued exploration.

4. The Mineral Resources were estimated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM Standards on Mineral Resources and Reserves, Definitions (2014) and Best Practices Guidelines (2019) prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

5. US$ Metal prices used were $80/Kg Nd 2 O 3 , $80/Kg Pr 6 O 11 , $1,500/Kg Sc 2 O 3 , $50/Kg Nb 2 O 5 , $250/t P 2 O 5 , $1.35/Kg CeO 2 , $1.35/Kg La 2 O 3 , $3.50/Kg Sm 2 O 3 , Nil$/t Ta 2 O 5 and $13.00/kg Y 2 O 3 , 0.78 FX all with combined process recoveries and payables of 50%, except P 2 O 5 at 75%.

6. The constraining pit optimization parameters were C$2.50/t mining cost for all material, C$25/t process cost, C$5/t G&A cost and 45-degree pit slopes with a C$30/t NSR cut-off.

Laura Giroux, P.Geo, Chief Geologist, acts as Nuinsco's Qualified Person under National Instrument 43-101. Ms. Giroux has reviewed and approved the technical content of this news release

About Nuinsco Resources Limited

Nuinsco Resources has over 50 years of exploration success and is a growth-oriented, multi-commodity mineral exploration and development company focused on prospective opportunities in Canada and internationally. Currently the Company has the large multi-commodity (phosphate, rare earth element, niobium, tantalum) Prairie Lake Project near Marathon-Terrace Bay, the Zig Zag Lake Property (lithium, tantalum) near Armstrong optioned to First Class Metals PLC, and the el Sid near-term gold project in Egypt and retains a NSR royalty on the Sunbeam Gold Property near Atikokan.

Forward-Looking Statements

The information in this news release may contain forward-looking statements or information (collectively, “ FLI ”) within the meaning of applicable Canadian securities legislation. FLI is based on expectations, estimates, projections, and interpretations as at the date of this document.

All statements, other than statements of historical fact, included herein are FLI that involve various risks, assumptions, estimates and uncertainties. Generally, FLI can be identified by the use of statements that include, but are not limited to, words such as “seeks”, “believes”, “anticipates”, “plans”, “continues”, “budget”, “scheduled”, “estimates”, “expects”, “forecasts”, “intends”, “projects”, “predicts”, “proposes”, "potential", “targets” and variations of such words and phrases, or by statements that certain actions, events or results “may”, “will”, “could”, “would”, “should” or “might”, “be taken”, “occur” or “be achieved.”

FLI in this document may include but is not limited to: statements regarding the use of proceeds of the Private Placement; the Company’s exploration plans, the tax treatment of the securities issued under the Private Placement under the Income Tax Act (Canada); the timing to renounce all qualifying expenditures in favour of the subscribers (if at all); MREs; results of metallurgical studies; and the future prospects of the Company .

FLI is designed to help you understand management’s current views of its near- and longer-term prospects, and it may not be appropriate for other purposes. FLI by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such FLI. Although the FLI contained in this document is based upon what management believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders and prospective purchasers of securities of the Company that actual results will be consistent with such FLI, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Company nor any other person assumes responsibility for the accuracy and completeness of any such FLI. Except as required by law, the Company does not undertake, and assumes no obligation, to update or revise any such FLI contained in this document to reflect new events or circumstances. Unless otherwise noted, this document has been prepared based on information available as of the date of this document. Accordingly, you should not place undue reliance on the FLI, or information contained herein.

Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in FLI.

Assumptions upon which FLI is based, without limitation, include: the results of exploration activities, the Company’s financial position and general economic conditions; the ability of exploration activities to accurately predict mineralization; the accuracy of geological modelling; the ability of the Company to complete further exploration activities; the legitimacy of title and property interests in the Deposits; the accuracy of key assumptions; the ability of the Company to obtain required approvals; geological, mining and exploration technical problems; failure of equipment or processes to operate as anticipated; the evolution of the global economic climate; metal prices; foreign exchange rates; environmental expectations; community and non-governmental actions; and, the Company’s ability to secure required funding. Risks and uncertainties about The Company's business are discussed in the disclosure materials filed with the securities regulatory authorities in Canada, which are available at www.sedarplus.ca .

Copyright (c) 2025 TheNewswire - All rights reserved.

© 2026 Canjex Publishing Ltd. All rights reserved.