Grand Baie, MAURITIUS, Oct. 03, 2024 (GLOBE NEWSWIRE) -- Alphamin Resources Corp. (AFM:TSXV, APH:JSE AltX)( “Alphamin” or the “Company”), is pleased to announce the declaration of an interim FY2024 dividend and provide an operational update for the quarter ended September 2024:

- Interim FY2024 dividend increased to CAD$0.06 per share (previously CAD$0.03 per share)

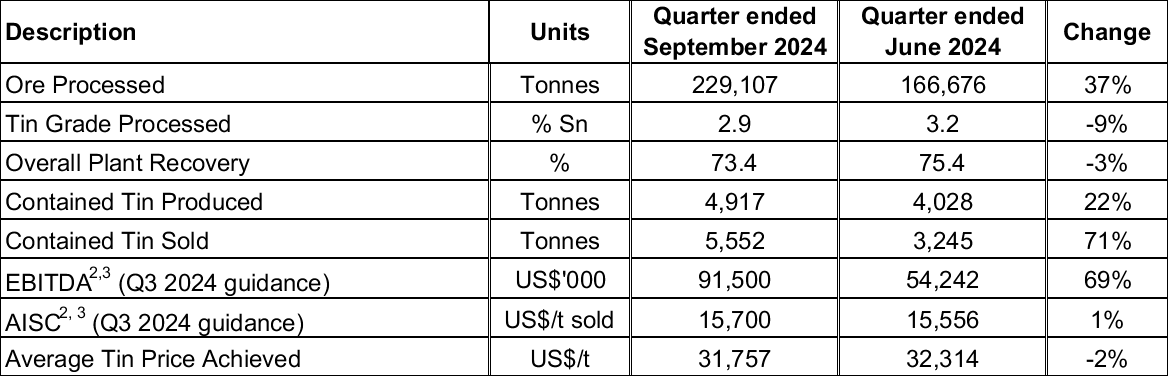

- Record quarterly tin production of 4,917 tonnes, up 22% from the prior quarter

- Q3 EBITDA3 guidance of US$91.5m, up 69% from actual EBITDA for the prior quarter

Operational and Financial Summary for the Quarter ended September 20241

__________________________________________________________________________________________

1Information is disclosed on a 100% basis. Alphamin indirectly owns 84.14% of its operating subsidiary to which the information relates.2Q3 2024 EBITDA and AISC represent management’s guidance.3This is not a standardized financial measure and may not be comparable to similar financial measures of other issuers.See “Use of Non-IFRS Financial Measures” below for the composition and calculation of this financial measure.

Operational and Financial Performance

Contained tin production of 4,917 tonnes for the quarter ended September 2024 was 22% above the prior period. This increase is a result of the Mpama South expansion contributing for a full quarter compared to half of the prior quarter. Ore processed increased by 37% to 229,107 tonnes and the tin grade of the feed ore reduced to 2.9%. This is in line with expectations as the Company targets annual processing volumes of 900,000 tonnes of ore at a tin grade of ~3%, producing approximately 20,000 tonnes of contained tin per year. Both processing facilities performed well during the quarter and achieved an overall plant recovery of 73.4%, in line with expectations.

Tin sales volumes increased by 71% to 5,552 tonnes which included the clearing of the ~600 tonnes sales backlog experienced in the prior quarter.

Guidance for AISC per tonne of tin sold is in line with the prior quarter at US$15,700 and includes the impact of tin prices on off-mine costs such as royalties, export duties, the smelter deductions and marketing fees, which are linked to movements in the tin price. Off-mine costs are expected to reduce from early Q4 2024 due to a ~60% reduction in marketing fees as a condition to the previously announced extension of the tin concentrate off-take agreement with Gerald Metals.

EBITDA for Q3 2024 is estimated to increase by 69% to US$91.5m (Q2 2024 actual: US$54.2m) due to higher tin production and sales volumes.

Alphamin’s unaudited consolidated financial statements and accompanying Management’s Discussion and Analysis for the quarter ended 30 September 2024 are expected to be released on or about 8 November 2024.

Alphamin and the tin market

Alphamin’s tin production expansion is being delivered against a period of weakness in global tin supply with major producing regions experiencing production challenges, while no obvious major investments are being made in the industry. Demand for tin in solar installations remains robust and semi-conductor sales, a proxy for tin’s application in electronics, are reportedly improving. Demand in other applications is expected to recover as major economies enter a lower interest rate cycle and the recently introduced economic stimulus in China takes effect. These dynamics bode well for the tin price while exchange traded tin stocks are on the decline.

Interim FY2024 Dividend Declared

The Board has declared an interim FY2024 cash dividend of CAD$0.06 per share on the common shares (approximately US$57 million in the aggregate) (the “Dividend”). The Dividend will be payable on November 4, 2024 to shareholders of record as of the close of business on October 25, 2024.

Qualified Person

Mr. Clive Brown, Pr. Eng., B.Sc. Engineering (Mining), is a qualified person (QP) as defined in National Instrument 43-101 and has reviewed and approved the scientific and technical information contained in this news release. He is a Principal Consultant and Director of Bara Consulting Pty Limited, an independent technical consultant to the Company.

_________________________________________________________________________________________

FOR MORE INFORMATION, PLEASE CONTACT:

Maritz Smith

CEO

Alphamin Resources Corp.

Tel: +230 269 4166

E-mail: msmith@alphaminresources.com

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Information in this news release that is not a statement of historical fact constitutes forward-looking information. Forward-looking statements contained herein include, without limitation, statements relating to EBITDA and AISC guidance for Q3 2024; expectations regarding annual targeted processing volumes, tin grades and contained tin production; expectations regarding the supply and demand for tin and the tin price. Forward-looking statements are based on assumptions management believes to be reasonable at the time such statements are made. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Although Alphamin has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. Factors that may cause actual results to differ materially from expected results described in forward-looking statements include, but are not limited to: the availability of ore at expected quantities and grades, uncertainties regarding global supply and demand for tin and market and sales prices together with the impact of reported and unreported global tin stocks on the tin price, uncertainties with respect to social, community and environmental impacts, uninterupted access to required infrastructure and third party service providers, uncertainties regarding the state of inbound and outbound roads and truck availabilities, adverse political events and risks of security related incidents which may impact the operation or safety of its people, uncertainties regarding the legislative requirements in the Democratic Republic of the Congo which may result in unexpected fines and penalties or the ability to continue with normal operations, impacts of the global Covid-19 pandemic or other health crises on mining operations and commodity prices as well as those risk factors set out in the Company’s annual Management Discussion and Analysis and other disclosure documents available under the Company’s profile at www.sedarplus.ca. Forward-looking statements contained herein are made as of the date of this news release and Alphamin disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

USE OF NON-IFRS FINANCIAL PERFORMANCE MEASURES

This announcement refers to the following non-IFRS financial performance measures:

EBITDA

EBITDA is profit before net finance expense, income taxes and depreciation, depletion, and amortization. EBITDA provides insight into our overall business performance (a combination of cost management and growth) and is the corresponding flow driver towards the objective of achieving industry-leading returns. This measure assists readers in understanding the ongoing cash generating potential of the business including liquidity to fund working capital, servicing debt, and funding capital expenditures and investment opportunities.

This measure is not recognized under IFRS as it does not have any standardized meaning prescribed by IFRS and is therefore unlikely to be comparable to similar measures presented by other issuers. EBITDA data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

CASH COSTS

This measures the cash costs to produce and sell a tonne of contained tin. This measure includes mine operating production expenses such as mining, processing, administration, indirect charges (including surface maintenance and camp and head office costs), and smelting, refining and freight, distribution and royalties. Cash Costs do not include depreciation, depletion, and amortization, reclamation expenses, capital sustaining, borrowing costs and exploration expenses. On mine costs, exclusive of stock movement, are calculated on a cost per tonne produced basis, off mine costs are calculated on a cost per tonne sold basis.

AISC

This measures the cash costs to produce and sell a tonne of contained tin plus the capital sustaining costs to maintain the mine, processing plant and infrastructure. This measure includes the Cash Cost per tonne and capital sustaining costs together divided by tonnes of contained tin produced. All-In Sustaining Cost per tonne does not include depreciation, depletion, and amortization, reclamation, borrowing costs, foreign exchange gains and losses, exploration expenses and expansion capital expenditures.

Sustaining capital expenditures are defined as those expenditures which do not increase payable mineral production at a mine site and excludes all expenditures at the Company’s projects and certain expenditures at the Company’s operating sites which are deemed expansionary in nature.

© 2026 Canjex Publishing Ltd. All rights reserved.