(All dollar amounts are in United States dollars unless otherwise indicated)

TSXV: MTA

NYSE American: MTA

VANCOUVER, BC, Aug. 12, 2022 /CNW/ - Metalla Royalty & Streaming Ltd. ("Metalla" or the "Company") (TSXV: MTA) (NYSE: MTA) announces its operating and financial results for the three and six months ended June 30, 2022. For complete details of the condensed interim consolidated financial statements and accompanying management's discussion and analysis for the three and six months ended June 30, 2022, please see the Company's filings on SEDAR (www.sedar.com) or EDGAR (www.sec.gov). Shareholders are encouraged to visit the Company's website at www.metallaroyalty.com.

Brett Heath, President, and CEO of Metalla, commented, "In the second quarter of 2022, we saw several significant advancements and milestones achieved within our royalty portfolio. G Mining's Tocantinzinho project secured a $481M financing package, expected to reach production in the second half of 2024. Wasamac's production profile was increased to 250k oz Au per year by Yamana Gold, making it an expected top 10 gold producer in Canada. We also saw discoveries made at Moneta's Garrison project and Canadian Malartic's Camflo property that look to provide even more potential upside. We are pleased to see our assets continue to advance and benefit from our strong counterparties at a time when equity and debt markets remain constrained."

FINANCIAL HIGHLIGHTS

During the six months ended June 30, 2022, and the subsequent period up to the date of this news release, the Company:

- Noted the following key milestones announced by operators of certain properties in its portfolio of royalties and streams (please see the 'Asset Updates' section of this press release for the details of these announcements):

- Monarch Mining Corporation ("Monarch") announced that new production has started at the Beaufor Mine (1.0% Net Smelter Returns ("NSR") royalty) to bring the total number of producing assets in which the Company has an interest to six, with the first royalty payment from Beaufor expected in the second half of 2022;

- G Mining Ventures Corp. ("G Mining") announced a $481 million financing package to fully fund the construction of the Tocantinzinho ("TZ") Gold Project (0.75% Gross Value Return ("GVR") royalty), targeting production for the second half of 2024;

- Yamana Gold Inc. ("Yamana") announced its second increase in the projected annual output from its Wasamac Mine (1.5% NSR royalty) since acquiring the project in 2021. Originally slated to produce 169 Koz annually when acquired by Yamana, the projected output has subsequently been raised to 250 Koz annually until at least 2030 and over 200 Koz annually over the initial 15 years. Bulk sample permit approvals are expected in early 2023 and ramp development could begin in spring 2023;

- Moneta Gold Inc. ("Moneta") announced a new discovery at the Garrison project (2.0% NSR royalty), where drilling to the west of the Garrcon Starter pit hit 50.09 g/t gold over 5.05 meters, highlighting the continued potential to significantly expand the Garrcon resource base and support an underground operation at the mine. Moneta expects to release an updated Preliminary Economic Assessment in the second half of 2022; and

- Yamana recently reported that the Canadian Malartic partnership had identified a porphyry-hosted gold mineralization that could potentially be mined via an open pit from the Camflo property (1.0% NSR royalty).

- Amended an existing 1.0% NSR royalty on Monarch's Beaufor Mine. In consideration for $1.0 million paid in cash to Monarch, Monarch agreed to waive a clause stipulating that payments under the NSR royalty were only payable after 100 Koz of gold have been produced by Monarch following its acquisition of Beaufor Mine. Payments under this NSR royalty will commence shortly as Monarch announced the start of production during July 2022 (see below).

- For the three months ended June 30, 2022, received or accrued payments on 560 attributable Gold Equivalent Ounces ("GEOs") at an average realized price of $1,844 and an average cash cost of $9 per attributable GEO (see non-IFRS Financial Measures). For the six months ended June 30, 2022, received or accrued payments on 1,284 attributable GEOs at an average realized price of $1,839 and an average cash cost of $7 per attributable GEO (see non-IFRS Financial Measures);

- For the three months ended June 30, 2022, recognized revenue from royalty and stream interests, including fixed royalty payments, of $0.5 million, net loss of $1.4 million, and adjusted EBITDA of negative $0.2 million (see non-IFRS Financial Measures). For the six months ended June 30, 2022, recognized revenue from royalty and stream interests, including fixed royalty payments, of $1.1 million, net loss of $3.6 million, and adjusted EBITDA of negative $0.2 million (see non-IFRS Financial Measures);

- For the three months ended June 30, 2022, generated operating cash margin of $1,835 per attributable GEO, and for the six months ended June 30, 2022, generate operating cash margin of $1,832 per attributable GEO, from the Wharf, Joaquin, and COSE royalties, the New Luika Gold Mine ("NLGM") stream held by Silverback Ltd. ("Silverback"), the Higginsville derivative royalty asset, and other royalty interests (see non-IFRS Financial Measures);

- For the three months ended June 30, 2022, recognized payments due or received (not included in revenue) from the Higginsville derivative royalty asset of $0.6 million, and for the six months ended June 30, 2022, recognized payments due or received from the Higginsville derivative royalty asset of $1.2 million (see non-IFRS Financial Measures);

- On May 12, 2022, the Company filed a new final short form base shelf prospectus and a corresponding registration statement on Form F-10 that replaced the base shelf prospectus and Form F-10 registration statement previously filed by the Company in 2020, and to enhance the Company's financial flexibility. In connection with this transition, the Company terminated its At-The-Market ("ATM") program announced on May 14, 2021 (the "2021 ATM Program"). From inception on May 14, 2021, to the termination on May 12, 2022, the Company distributed 1,990,778 common shares under the 2021 ATM program at an average price of $8.18 per share for gross proceeds of $16.3 million, of which 20,170 common shares were sold during the three months ended June 30, 2022, at an average price of $7.13 per common share for gross proceeds of $0.1 million;

- On May 27, 2022, the Company announced that it had entered into a new equity distribution agreement with a syndicate of agents to establish an ATM equity program (the "2022 ATM Program") under which the Company may distribute up to $50.0 million (or the equivalent in Canadian Dollars) in common shares of the Company. From inception to the date of this press release, the Company did not distribute any common shares under the 2022 ATM program; and

- In August 2022, the Company and Beedie Capital entered into an agreement to extend the maturity date of its loan facility from April 21, 2023, to January 22, 2024 (the "Loan Extension"). In consideration for the Loan Extension the Company incurred a fee of 2.0% of the currently drawn amount of C$8.0 million, the C$160,000 fee will be convertible into common shares at a conversion price of C$7.34 per share, calculated based on a 20% premium to the 30-day Volume Weighted Average Price of the Company's common shares on the trading day immediately prior to the effective date of the Loan Extension. The Loan Extension is subject to stock exchange approvals which are pending.

ASSET UPDATES

Beaufor Mine

On July 5, 2022, Monarch announced that it had begun processing ore from its Beaufor Mine at its wholly-owned Beacon Mill, it reported it had stockpiled a total of 30,549 tonnes of ore averaging 4.76 g/t gold and would start feeding the mill with that ore and expected to pour its first bar of gold in July 2022. On July 27, 2022, Monarch further announced the production of its first gold bar from the Beaufor Mine, and announced it expects to reach commercial production in the coming months.

On June 16, 2022, Monarch reported results from recent drilling at the Q Zone where significant intercepts include 122 g/t over 1.4 meters, 20.74 g/t over 3.3 meters, 83.2 g/t gold over 0.5 meters and 18.87 g/t gold over 1.2 meters. On July 25, 2022, Monarch reported high grade results from drilling at the Q Zone that included 37.59 g/t gold over 2.5 meters, 29.79 g/t gold over 2.45 meters and 418 g/t gold over 0.63 meters, highlighting the potential to expand the Q Zone at depth.

Metalla holds a 1.0% NSR royalty on the Beaufor mine.

Wharf Royalty

On August 3, 2022, Coeur Mining Inc. ("Coeur") reported second quarter production of 20.4 Koz gold at 0.47 g/t gold, in line with the 70-80 Koz full year guidance for Wharf disclosed by Wharf on February 16, 2022. During the quarter, one reverse circulation ("RC") drill rig had completed a resource conversion program at the Portland-Ridge-Boston claim group and at the Flossie area.

On February 16, 2022, Coeur reported that Wharf's updated Proven and Probable Reserves totaled 852 Koz at 0.73 g/t. Total Measured and Indicated Resources were reported at 412 Koz at 0.63g/t with an Inferred Resource estimate of 90 Koz at 0.75 g/t. In addition, Coeur reported in their Q4 2021 financial statements, an updated mine life of 8 years for Wharf. Additionally, Coeur reported the continued exploration success at Wharf where a total of 6,625 meters of drilling was completed in the Portland Ridge - Boston claim group, Flossie and Juno areas. Coeur spent $4 million on exploration at the mine in 2021, its largest since acquiring the asset in 2015.

Metalla holds a 1.0% GVR royalty on the Wharf mine.

New Luika Silver Stream

On July 21, 2022, Shanta Gold Limited ("Shanta") reported that it produced 17.5 Koz of gold at its NLGM in Tanzania in the second quarter of 2022, in line with full year production guidance of 68-76 Koz gold. On July 19, 2021, Shanta announced a new mine plan for NLGM, where average annual production is expected to be 73.6 Koz gold with the potential to extend mine life beyond 2026 through conversion of significant known resources and the expanded 2,450 tpd mill throughput. Shanta expects total gold production from NLGM for the five-year plan to total 368 Koz from both open pit and underground mine sources from the mining license.

Metalla holds a 15% interest in Silverback, whose sole business is receipt and distribution of a 100% silver stream on NLGM at an ongoing cost of 10% of the spot silver price.

Cote-Gosselin

On August 3, 2022, IAMGOLD Corporation ("IAMGOLD") reported that construction had reached 57% completion at the Cote Gold Project. It also reported completion in the second quarter of 2022 of approximately 10,500 meters of the 16,000 meter drill program is planned in 2022 to further delineate and expand the Gosselin mineral resources and test selected targets along the deposit corridor. In addition, IAMGOLD completed a project update to the Cote life-of-mine plans where the update proposes an 18-year mine life with initial production expected in early 2024. Average annual production during the first six years is expected to be 495 Koz gold and 365 Koz over the life-of-mine.

Metalla holds a 1.35% NSR royalty that covers less than 10% of the Cote reserves and resources estimate and covers all of the Gosselin resource estimate.

Castle Mountain

Castle Mountain is slated to become one of Equinox Gold's ("Equinox") largest assets. Metalla's 5.0% NSR royalty covers the South Domes portion of the deposit which will be part of the Phase 2 expansion slated to begin in 2026.

On August 3, 2022, Equinox reported production in the second quarter of 6.7 Koz gold and exploration expenditure in the second quarter of $0.5 million at the Castle Mountain property. This was in addition to the exploration announced on May 3, 2022, where drilling in the first quarter included 7,948 meters of RC drilling across the South dump area to assess the continuity and distribution of grade. Equinox also completed 1,448 meters of RC drilling in the area between the JSLA and South Domes pits.

Equinox also announced that in March 2022 it had submitted applications to amend existing permits to accommodate the Phase 2 expansion. On February 24, 2022, Equinox announced they expect to spend $7 million for Phase 2 permitting, optimization studies and metallurgical test work and nearly $2 million for exploration. As of August 3, 2022, the Phase 2 permitting timeline was on schedule with the San Bernardino County having determined the application was complete. Equinox expects the U.S. Bureau of Land management to complete its completeness review by the end of July with the application reviews to run through to the end of 2022. Both agencies will determine the appropriate level of state and federal environmental review required with the resulting review process anticipated to begin by early 2023.

Metalla holds a 5.0% NSR royalty on the South Domes area of the Castle Mountain mine.

Garrison

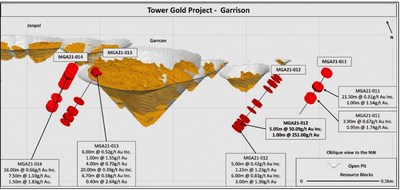

On July 7, 2022, Moneta released the results of exploration drilling at the Garrison deposit in their Tower Gold project. Drilling results tested new areas all within the Tower Gold project, including east and west of the Garrcon resource, south of the Westaway resource at South Basin, east of the Windjammer South resource at Halfway, and west of the 55 deposit. Drilling has confirmed significant gold mineralization beyond the current resource. Highlights include a drill hole that intercepted significant mineralization with 50.09 g/t gold over 5.05 meters and 0.66 g/t gold over 16 meters. The holes highlight the potential to expand the Garrcon resource pit shells and open new targets for future exploration drilling.

On May 11, 2022, Moneta released an updated resource estimate for the Tower Gold project, including 4.27 Moz gold in the Indicated category and 7.5 Moz gold in the Inferred category. Moneta plans to complete a Preliminary Economic Assessment on the project scheduled for completion later in the second quarter of 2022. The Garrison deposit forms part of the Tower project and is comprised of three zones, Garrcon, Jonpol, and 903. At Garrcon, the open pit Indicated Resource is 841 Koz at 1.02 g/t gold with an Inferred Resource of 15Koz at 0.67 g/t gold, the underground portion has an Indicated Resource of 87 Koz at 5.08 g/t gold with an Inferred Resource of 120 Koz at 4.98 g/t gold. The Jonpol zone has an Indicated Resource of 297 Koz at 1.4 g/t gold and an Inferred Resource of 114 Koz at 0.99 g/t gold. The 903 zone has an Indicated Resource of 610 Koz at 1.01 g/t gold and an Inferred Resource of 600 Koz at 0.74 g/t gold. The Garrison starter pit now has an Indicated Resource of 1.75 Moz at 1.07 g/t gold. Moneta is slated to release a PEA in the second half of 2022.

Metalla holds a 2.0% NSR royalty on the Garrison project.

Wasamac

On July 7, 2022, Yamana announced the approval of the Wasamac bulk sample program, providing for earlier access to the deposit and to increase the level of confidence in the future mining of the project. Permit approvals are expected in early 2023 with ramp development potentially beginning in Spring 2023. A reassessment of the Wasamac project highlighted an improved gold production profile compared to the feasibility study with new projections of ramp-up to 200 Koz in 2027 and up to 250 Koz in 2028. Ongoing mine design and sequence optimizations could position Wasamac with the option for future incremental expansion of the mill to 9,000 tpd from 7,000 tpd in year 3 of operations which will extend the gold production profile of 250 Koz per year until at least 2030. Yamana also highlighted additional opportunities not included in the strategic plan which include processing flow sheet optimization to increase metallurgical recoveries by approximately 3%, optimized configuration of the tailings filter plant and paste backfill plant. Yamana also announced that bulk sample permits are scheduled for submission in the third quarter of 2022, with the approval expected in early 2023 and ramp development could begin in spring 2023.

On July 27, 2022, Yamana announced positive results from infill drilling at the Wasamac project where grades continue to exceed expectations with significant results include 5.05 g/t gold over 54.06 meters and 5.45 g/t gold over 16.8 meters. Exploration drilling at the Wildcat South target continued to expand on the discovery with a significant intercept of 7.31 g/t gold over 3.37 meters and 1.46 g/t gold over 12.3 meters.

Metalla holds a 1.5% NSR royalty on the Wasamac project subject to a buy back of 0.5% for C$7.5 million.

Amalgamated Kirkland Property

On July 27, 2022, Agnico Eagle Mines Limited ("Agnico") reported that an assessment was ongoing at the Amalgamated Kirkland deposit to provide incremental ore feed to the Macassa mill with annual production of 40 Koz as soon as 2024. The Macassa underground ramp had been extended by 615 meters and twenty-four drill holes had been completed in the higher-grade portion of the deposit. Significant intercepts from the underground drill program include 14.1 g/t gold over 6.5 meters, 23.9 g/t gold over 2.0 meters and 14.9 g/t gold over 3.0 meters. Drilling from the surface drill program designed to infill near surface mineralization proves to be successful in confirming grade thicknesses with significant intercepts of 6.9 g/t gold over 6.7 meters, 5.9 g/t gold over 6 meters and 9 g/t gold over 9.2 meters.

In 2022, Agnico plans to spend $8.6 million on a 1.3 kilometre exploration ramp from the Macassa near surface zones, designed to carry out infill drilling and a bulk sample of the higher-grade regions of the Amalgamated Kirkland deposit. On April 28, 2022, Agnico reported that the Amalgamated Kirkland deposit hosts an Indicated Resource estimate of 265 Koz gold at 6.51 g/t gold and an Inferred Resource of 406 Koz at 5.32 g/t gold. The deposit remains open at depth and extends laterally.

Metalla holds a 0.45% NSR royalty on the Amalgamated Kirkland property.

El Realito

On July 27, 2022, Agnico reported that pre-stripping of the El Realito pit was approximately 81% compete. Pre-stripping activities at El Realito pit are in line with forecast are expected to be completed in the third quarter of 2022. The production guidance in Agnico's February 23, 2022, press release for the La India mine which hosts the El Realito pit were positively revised to 82.5 Koz gold in 2022, 70 Koz gold in 2023 and 22.5 Koz gold in 2024. The increase in the production guidance was due to pit optimization and increase in mineral reserves at the El Realito deposit.

Metalla holds a 2.0% NSR royalty on the El Realito deposit which is subject to a 1.0% buyback right for $4.0 million.

Del Carmen

On May 4, 2022, Barrick Gold Corporation reported that drilling at Del Carmen resumed in the second quarter of 2022, drilling will continue until the winter season. Results received at Carmen Norte, located to the north of the Rojo Grande target, confirmed gold mineralization with an intercept of 0.5 g/t gold over 39 meters, which opens up a new area with upside potential to add resources to Del Carmen. In addition, all geological models grade estimates and geometallurgical models with be updated and rebuilding in the second quarter to inform future steps for the project.

Metalla holds a 0.5% NSR royalty on the Del Carmen project which is the Argentine portion of the Alturas-Del Carmen project in the prolific El Indio belt.

Fifteen Mile Stream

On July 27, 2022, St. Barbara Limited reported that the Fifteen Mile Stream project has been extended to include all four identified resource open pits and enable development of the full potential of the project. Permitting application for Fifteen Mile Stream under the Canadian Federal protocol have been made and will be determined in August 2022.

Metalla holds a 1.0% NSR royalty on the Fifteen Mile Stream project, and 3.0% NSR royalty on the Plenty and Seloam Brook deposits.

Tocantinzinho

On July 18, 2022, G Mining announced a $481 million financing package, which included a gold stream, term-loan, and equity placement from Franco-Nevada Corporation for $353 million, for the development of the TZ Gold Project located in Para State, Brazil, providing for full financing required for the project. In addition, Eldorado Gold and La Mancha participated for $89 million in equity placements. Project financing is now in place for full construction to begin in Q3 2023 and targeting production for the second half of 2024.

G Mining had previously announced a feasibility study for the TZ Gold Project was completed in the previous quarter, which confirmed a 10.5-year mine life producing 1.8 Moz of gold in total resulting in an average annual gold production profile of 174,700 ounces at an all-in sustaining cost of $681/oz.

Economics were favourable, at a $1,600/oz gold price the study demonstrated an after-tax NPV5% of $622 million and generated an after-tax IRR of 24%. Also of note, G Mining increased the reserves at TZ by 12% to 2.0 Moz and saw an increase in the capital cost at the project of only 7% since the last study was conducted. Project optimization and detailed engineering is expected to occur from Q4 2021 through to Q4 2022. G Mining also expects to complete two drilling campaigns totaling 10,000 meters beginning in Q4 2021 through to Q1 2022, these include a grade control drilling program to de-risk early years of production and an exploration drilling program to test for potential extensions of the known mineralization at depth and below the current pit.

G Mining is a precious metals development company with a leadership team which has built four mines in South America, including the Merian mine for Newmont Corporation and Fruta Del Norte for Lundin Gold.

Metalla holds a 0.75% GVR royalty on the Tocantinzinho project.

Fosterville

On July 27, 2022, Agnico reported that gold production from Fosterville for the first six months of the operation was 168 Koz gold. During the quarter, the Robbins Hill and Phoenix exploration declines were completed allowing for the advancement of exploration drilling in the prospective areas.

On February 23, 2022, Agnico reported that they expect to spend $34.6 million for 121,400 metres of drilling and development to replace mineral reserve depletion and to add mineral resources at the Fosterville mine. Agnico announced that another $19.7 million will be spent on underground and surface exploration with the aim to discover additional high-grade mineralization, with $2.9 million to be spent on regional exploration drilling on the land package surrounding the mine.

Metalla holds a 2.5% GVR royalty on the Northern and Southern extensions of the Fosterville mining license and other areas in the land package.

CentroGold

On July 25, 2022, Oz Minerals stated that the relocation plan required for progressing the court injunction removal for CentroGold was still in review with the National Institute of Colonization and Agrarian Reform (INCRA). In addition, exploration expenses of $0.9 million were spent on the project for the quarter.

Metalla holds a 1.0-2.0% NSR royalty on the CentroGold project.

Camflo

On July 27, 2022, Yamana reported the Canadian Malartic partnership has identified porphyry hosted gold mineralization that could potentially be mined via an open pit at the Camflo property and provide tonnage to the Canadian Malartic operation. Additional studies are underway to fully evaluate the mineralization and additional potential in adjacent rock types. An aggressive drill program is planned in 2023. The Camflo property covers the past producing Camflo mine which had historical production of approximately 1.6 Moz of gold.

Metalla holds a 1.0% NSR royalty on the Camflo mine, located ~1km northeast of the Canadian Malartic operation.

Montclerg

Through press releases dated July 20, 2022, and June 23, 2022, GFG Resources Inc. ("GFG") reported high grade intervals at the Montclerg Gold Project located 48 km east of the Timmins Gold District. Significant intercepts include 1.32 g/t gold over 33.5 meters, 1.6 g/t gold over 70.4 meters and a 4.95 g/t gold over 8.3 meters. Step-out drilling has demonstrated the Montclerg deposit continues for 530 meters to the east and remains open. GFG are planning to complete a 8,000-10,000 meter drill program in 2022.

Metalla holds a 1.0% NSR royalty on the Montclerg property.

Detour DNA

On July 28, 2022, Agnico reported that exploration plans will investigate the Sunday Lake deformation zone along strike to the west and east of the mine. In addition, step out drilling two kilometres west of the current pit out has encountered significant intersections including 32.3 g/t gold over 4.8 meters outlining the potential for an underground operation.

Metalla holds a 2.0% NSR royalty on the Detour DNA property which is ~7km west of the Detour West reserve pit margin.

Green Springs

On August 9, 2022, Contact Gold reported results from the first 3 drill holes from the 2022 step-out drill program at the Green Springs oxide gold project in the Cortez Trend, Nevada. Significant results from the X-Ray zone include 1.66 g/t gold over 28.96 meters and 0.82 g/t gold over 35.05 meters. Results from the remaining 20 holes are pending.

Metalla holds a 2.0% NSR royalty on the Green Springs project.

Red Hill

On June 21, 2022, NuLegacy Gold Corporation reported an updated exploration plan for Red Hill for 2022-2023 with a 29-hole program expected to have begun in July 2022.

Metalla holds a 1.5% GOR royalty on the Red Hill property which is in close proximity to Nevada Gold Mines Cortez operations.

QUALIFIED PERSON

The technical information contained in this news release has been reviewed and approved by Charles Beaudry, geologist M.Sc., member of the Association of Professional Geoscientists of Ontario and of the Ordre des Geologues du Quebec and a director of Metalla. Mr. Beaudry is a QP as defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects.

ABOUT METALLA

Metalla is a precious metals royalty and streaming company. Metalla provides shareholders with leveraged precious metal exposure through a diversified and growing portfolio of royalties and streams. Our strong foundation of current and future cash-generating asset base, combined with an experienced team gives Metalla a path to become one of the leading gold and silver companies for the next commodities cycle.

For further information, please visit our website at www.metallaroyalty.com

ON BEHALF OF METALLA ROYALTY & STREAMING LTD.

(signed) "Brett Heath"

President and CEO

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accept responsibility for the adequacy or accuracy of this release.

Non-IFRS Measures

The items marked above are alternative performance measures and readers should refer to non-international financial reporting standards ("IFRS") financial measures in the Company's Management's Discussion and Analysis for the three and six months ended June 30, 2022, as filed on SEDAR and as available on the Company's website for further details. Metalla has included certain performance measures in this press release that do not have any standardized meaning prescribed by IFRS including (a) attributable gold equivalent ounces (GEOs), (b) average cash cost per attributable GEO, (c) average realized price per attributable GEO, (d) operating cash margin per attributable GEO, which is based on the two preceding measures, and (e) adjusted EBITDA. In the precious metals mining industry, this is a common performance measure but does not have any standardized meaning. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's performance and ability to generate cash flow. The presentation of these non-IFRS measures is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. Other companies may calculate these non-IFRS measures differently.

Technical and Third-Party Information

Metalla has limited, if any, access to the properties on which Metalla holds a royalty, stream or other interest. Metalla is dependent on (i) the operators of the mines or properties and their qualified persons to provide technical or other information to Metalla, or (ii) publicly available information to prepare disclosure pertaining to properties and operations on the mines or properties on which Metalla holds a royalty, stream or other interest, and generally has limited or no ability to independently verify such information. Although Metalla does not have any knowledge that such information may not be accurate, there can be no assurance that such third-party information is complete or accurate. Some information publicly reported by operators may relate to a larger property than the area covered by Metalla's royalty, stream or other interests. Metalla's royalty, stream or other interests can cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, resources and production of a property.

Unless otherwise indicated, the technical and scientific disclosure contained or referenced in this press release, including any references to mineral resources or mineral reserves, was prepared in accordance with Canadian National Instrument 43-101 ("NI 43-101"), which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the "SEC") applicable to U.S. domestic issuers. Accordingly, the scientific and technical information contained or referenced in this press release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC.

"Inferred mineral resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Historical results or feasibility models presented herein are not guarantees or expectations of future performance.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking information" and "forward-looking statements" (collectively, "forward looking statements") within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this press release only, and the Company does not assume any obligation to update or revise them except as required by applicable law.

All statements included herein that address events or developments that we expect to occur in the future are forward-looking statements. Generally, forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects", "does not expect", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking statements and information include, but are not limited to: the successful completion of certain milestones in respect to the CentroGold project; the satisfaction of future payment obligations and contingent commitments by Metalla; the effectiveness, and potential use and benefit of, the Company's final short form base shelf prospectus and Form F-10 registration statement; the future sales of common shares under the 2022 ATM program and the value of the gross proceeds to be raised; the completion by property owners of announced drilling programs, capital expenditures, and other planned activities in relation to properties on which the Company and its subsidiaries hold a royalty or streaming interest and the expected timing thereof; production and life of mine estimates or forecasts at the properties on which the Company and its subsidiaries hold a royalty or streaming interest; the closing of the Loan Extension; future disclosure by property owners and the expected timing thereof; the completion by property owners of announced capital expenditure programs; the estimated production at Beaufor, Wharf, Higginsville, Beta Hunt, NLGM and La India;; the results of the permitting application for Fifteen Mile Stream under the Canadian Federal protocol; the anticipated results from the recently completed RC drill rig resource conversion program at the Portland-Ridge-Boston claim group and at the Flossie area; the completion of the drill program to further delineate and expand the Gosselin mineral resources and test selected targets along the deposit corridor;; the completion of a Preliminary Economic Assessment on the Tower Gold Project, and the timing thereof; the completion of pre-stripping activities at El Realito and the expected timing thereof; the future start of mining operations at Beacon Mill and the expected timing thereof; the progression of the court injunction removal at the CentroGold property; expectation that the U.S. Bureau of Land management will compete its completeness review by the end of July with the application reviews to run through to the end of 2022 with respect to the Phase 2 permit application for Castle Mountain; future opportunities for Equinox Gold to move South Domes earlier in the mine plan at Castle Mountain; the potential for Castle Mountain mine to become one of Equinox Gold's largest assets; expected timing of the preliminary economic assessment at the Tower Gold project by Moneta; the completion of two drilling campaigns at Tocantinzinho and the anticipated timing thereof; anticipated results of the completed exploration declines at Fosterville mine, including the feasibility for the advancement of exploration drilling in the prospective areas; the expectation that G Mining's $481 million financing package will fully fund the construction of the TZ Gold Project, and the anticipated timing thereof; the potential for product at the TZ Gold Project and the timing thereof; the anticipated timing of the bulk sample approvals in respect to the Wasamac Mine; engaging in ramp development at the Wasamac Mine and the timing thereof; the potential to significantly expand the Garrcon resource base and support an underground operation at the mine; the release an updated Preliminary Economic Assessment by Moneta with respect to the Garrison Project, and the anticipated timing thereof; the potential that the porphyry hosted gold mineralization identified by the Canadian Malartic partnership may be mined via an open pit from the Camflo property (1.0% NSR); continuation of the drilling at Del Carmen; receipt of permits for Fifteen Mile Steam under the Canadian Federal protocol, and timing thereof; investigation of the Sunday Lake deformation, and anticipated results thereof; the completion of project optimization and detailed engineering at Tocantinzinho and the anticipated timing thereof; the replacement of mineral reserve depletion and addition of mineral resources at the Fosterville mine; the potential production at the Wasamac project; the future production at the Amalgamated Kirkland deposit and the anticipated timing thereof;the amount and timing of the attributable GEOs expected by the Company in 2022; the future production at El Realito and the anticipated timing thereof; the increase of producing royalties to seven; future expectations regarding the royalties and streams of Metalla; royalty payments to be paid to Metalla by property owners or operators of mining projects pursuant to each royalty; the mineral reserves and resource estimates for the properties with respect to which the Company has or proposes to acquire an interest; future gold and silver prices;other potential developments relating to, or achievements by the counterparties for Metalla's stream and royalty agreements, and with respect to the mines and other properties in which Metalla has, or may acquire, a stream or royalty interest;andestimates of future production, costs and other financial or economic measures.

Such forward-looking statements reflect management's current beliefs and are based on information currently available to management. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties, and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Metalla to control or predict, that may cause Metalla's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: risks associated with the impact of general business and economic conditions; the absence of control over mining operations from which Metalla will purchase precious metals or from which it will receive stream or royalty payments and risks related to those mining operations, including risks related to international operations, government and environmental regulation, delays in mine development, construction and operations, actual results of mining and current exploration activities, conclusions of economic evaluations and changes in project parameters as plans are refined; problems related to the ability to market precious metals or other metals; industry conditions, including commodity price fluctuations, interest and exchange rate fluctuations; interpretation by government entities of tax laws or the implementation of new tax laws; regulatory, political or economic developments in any of the countries where properties in which Metalla holds a royalty, stream or other interest are located or through which they are held; risks related to the operators of the properties in which Metalla holds a royalty or stream or other interest, including changes in the ownership and control of such operators; risks related to global pandemics, including the novel coronavirus (COVID-19) global health pandemic, and the spread of other viruses or pathogens; influence of macroeconomic developments; business opportunities that become available to, or are pursued by Metalla; reduced access to debt and equity capital; litigation; title, permit or license disputes related to interests on any of the properties in which Metalla holds a royalty, stream or other interest; the volatility of the stock market; competition; future sales or issuances of debt or equity securities; inability to obtain stock exchange approvals or otherwise satisfy the conditions to close the Loan Extension; use of proceeds; dividend policy and future payment of dividends; liquidity; market for securities; enforcement of civil judgments; and risks relating to Metalla potentially being a passive foreign investment company within the meaning of U.S. federal tax laws, as the other risks and uncertainties disclosed under the heading "Risk Factors" in the Company's most recent Annual Information Form, annual report on Form 40-F and other documents filed with or submitted to the Canadian securities regulatory authorities on the SEDAR website at www.sedar.com and the U.S. Securities and Exchange Commission on the EDGAR website at www.sec.gov. Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. We are under no obligation to update or alter any forward-looking statements except as required under applicable securities laws. For the reasons set forth above, undue reliance should not be placed on forward-looking statements.

Website: www.metallaroyalty.com

View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-reports-financial-results-for-the-second-quarter-of-2022-and-provides-asset-updates-301605223.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/metalla-reports-financial-results-for-the-second-quarter-of-2022-and-provides-asset-updates-301605223.html

SOURCE Metalla Royalty and Streaming Ltd.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2022/12/c8285.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/August2022/12/c8285.html

Brett Heath, President & CEO, Phone: 604-696-0741, Email: info@metallaroyalty.com; Kristina Pillon, Investor Relations, Phone: 604-908-1695, Email: kristina@metallaroyalty.com